Bitcoin tax rate canada images are ready. Bitcoin tax rate canada are a topic that is being searched for and liked by netizens today. You can Find and Download the Bitcoin tax rate canada files here. Get all free photos.

If you’re searching for bitcoin tax rate canada images information linked to the bitcoin tax rate canada topic, you have visit the right site. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

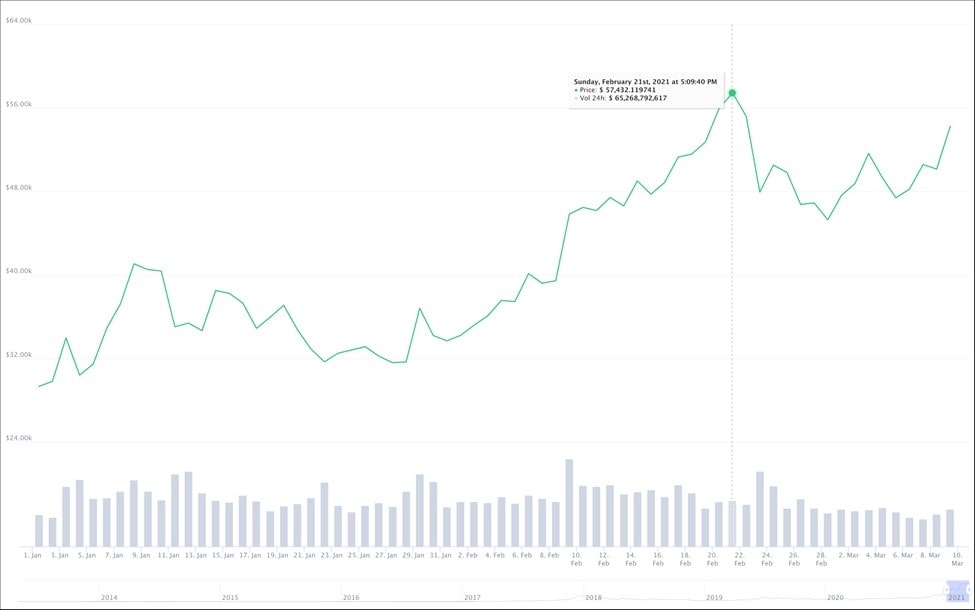

Bitcoin Tax Rate Canada. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as. Although the currency is decentralized meaning it belongs to no central bank any profits made in cryptocurrency in Canada. It is calculated as follows. The portion of the Canada Revenue Agencys tax code regarding securities exchanges applies to these transactions.

Cryptocurrency Regulation In Canada 2020 Tookitaki Tookitaki From tookitaki.ai

Cryptocurrency Regulation In Canada 2020 Tookitaki Tookitaki From tookitaki.ai

Although the currency is decentralized meaning it belongs to no central bank any profits made in cryptocurrency in Canada. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as. Depending on your circumstances taxes. The portion of the Canada Revenue Agencys tax code regarding securities exchanges applies to these transactions. For example if you purchased 200 bitcoins. Francis originally bought those Bitcoins for 15000 and exchanged them for 100 units of Ethereum at a value of 20600 resulting in a capital gain.

For example if you purchased 200 bitcoins.

It is calculated as follows. Francis originally bought those Bitcoins for 15000 and exchanged them for 100 units of Ethereum at a value of 20600 resulting in a capital gain. Although the currency is decentralized meaning it belongs to no central bank any profits made in cryptocurrency in Canada. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as. For example if you purchased 200 bitcoins. 20600 fair market value of 25061 Bitcoins at the time of transaction - 15000 adjusted cost base of 25061 Bitcoins.

Source: reviewlution.ca

Source: reviewlution.ca

It is calculated as follows. It is calculated as follows. If you buy hold and sell virtual currency and make a profit in the process you must claim that profit as a capital gains. If youre making money in any cryptocurrency like Bitcoin or Ethereum you may be wondering how to manage that income when filing your taxes. The portion of the Canada Revenue Agencys tax code regarding securities exchanges applies to these transactions.

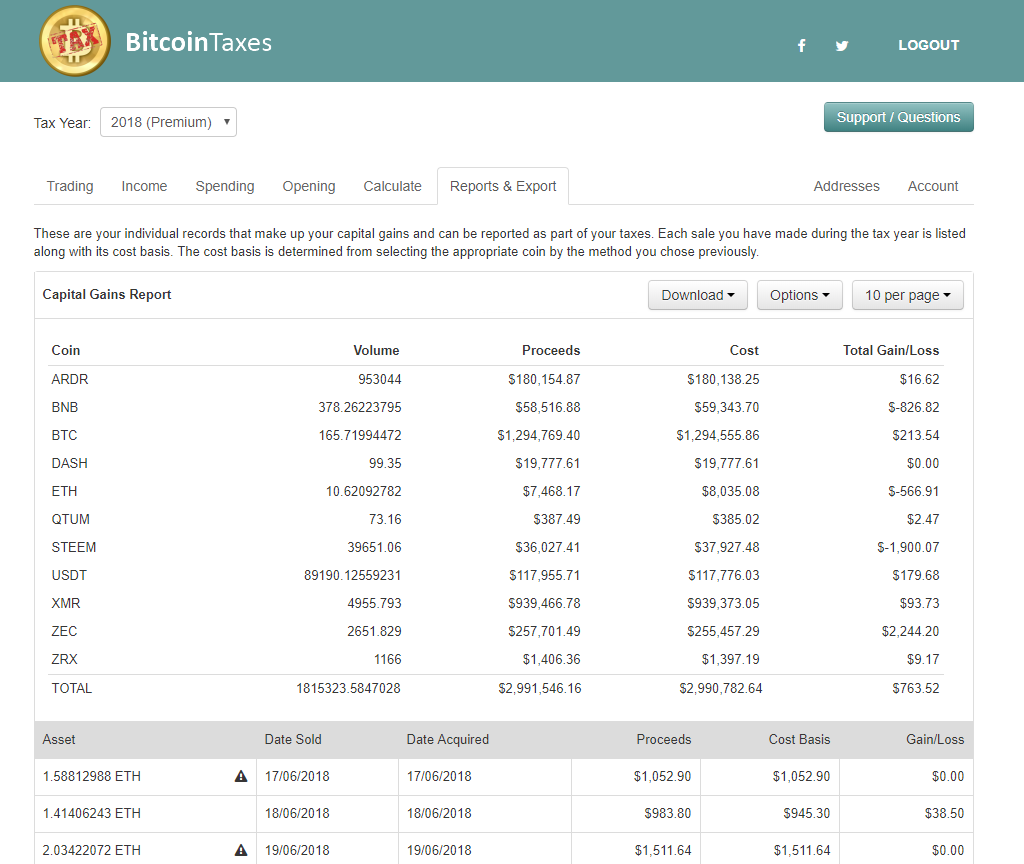

Source: bitcoin.tax

Source: bitcoin.tax

If you buy hold and sell virtual currency and make a profit in the process you must claim that profit as a capital gains. If you buy hold and sell virtual currency and make a profit in the process you must claim that profit as a capital gains. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as. If youre making money in any cryptocurrency like Bitcoin or Ethereum you may be wondering how to manage that income when filing your taxes. The way cryptocurrencies are taxed in Canada mean that investors might still need to pay tax regardless of if they made an overall profit or loss.

Source: reviewlution.ca

Source: reviewlution.ca

Francis originally bought those Bitcoins for 15000 and exchanged them for 100 units of Ethereum at a value of 20600 resulting in a capital gain. The way cryptocurrencies are taxed in Canada mean that investors might still need to pay tax regardless of if they made an overall profit or loss. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as. 20600 fair market value of 25061 Bitcoins at the time of transaction - 15000 adjusted cost base of 25061 Bitcoins. Francis originally bought those Bitcoins for 15000 and exchanged them for 100 units of Ethereum at a value of 20600 resulting in a capital gain.

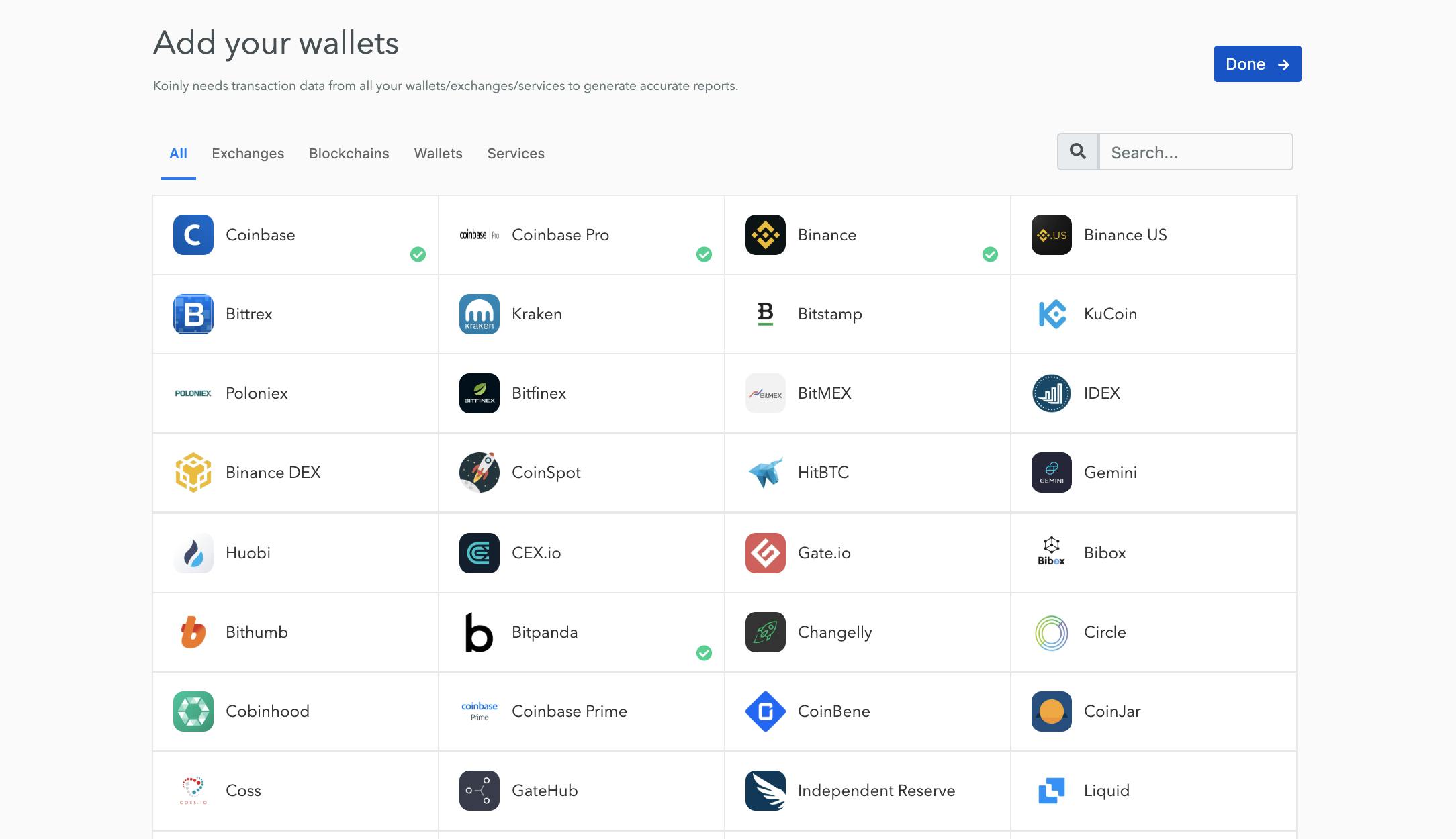

Source: koinly.io

Source: koinly.io

If youre making money in any cryptocurrency like Bitcoin or Ethereum you may be wondering how to manage that income when filing your taxes. Although the currency is decentralized meaning it belongs to no central bank any profits made in cryptocurrency in Canada. It is calculated as follows. Depending on your circumstances taxes. The way cryptocurrencies are taxed in Canada mean that investors might still need to pay tax regardless of if they made an overall profit or loss.

For example if you purchased 200 bitcoins. Depending on your circumstances taxes. Francis originally bought those Bitcoins for 15000 and exchanged them for 100 units of Ethereum at a value of 20600 resulting in a capital gain. For example if you purchased 200 bitcoins. If youre making money in any cryptocurrency like Bitcoin or Ethereum you may be wondering how to manage that income when filing your taxes.

Source: bitcoin.tax

Source: bitcoin.tax

The way cryptocurrencies are taxed in Canada mean that investors might still need to pay tax regardless of if they made an overall profit or loss. If youre making money in any cryptocurrency like Bitcoin or Ethereum you may be wondering how to manage that income when filing your taxes. 20600 fair market value of 25061 Bitcoins at the time of transaction - 15000 adjusted cost base of 25061 Bitcoins. It is calculated as follows. Depending on your circumstances taxes.

The portion of the Canada Revenue Agencys tax code regarding securities exchanges applies to these transactions. Although the currency is decentralized meaning it belongs to no central bank any profits made in cryptocurrency in Canada. 20600 fair market value of 25061 Bitcoins at the time of transaction - 15000 adjusted cost base of 25061 Bitcoins. Francis originally bought those Bitcoins for 15000 and exchanged them for 100 units of Ethereum at a value of 20600 resulting in a capital gain. It is calculated as follows.

20600 fair market value of 25061 Bitcoins at the time of transaction - 15000 adjusted cost base of 25061 Bitcoins. If youre making money in any cryptocurrency like Bitcoin or Ethereum you may be wondering how to manage that income when filing your taxes. 20600 fair market value of 25061 Bitcoins at the time of transaction - 15000 adjusted cost base of 25061 Bitcoins. The way cryptocurrencies are taxed in Canada mean that investors might still need to pay tax regardless of if they made an overall profit or loss. For example if you purchased 200 bitcoins.

Source: tookitaki.ai

Source: tookitaki.ai

Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as. The portion of the Canada Revenue Agencys tax code regarding securities exchanges applies to these transactions. It is calculated as follows. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as. If youre making money in any cryptocurrency like Bitcoin or Ethereum you may be wondering how to manage that income when filing your taxes.

The way cryptocurrencies are taxed in Canada mean that investors might still need to pay tax regardless of if they made an overall profit or loss. The portion of the Canada Revenue Agencys tax code regarding securities exchanges applies to these transactions. The way cryptocurrencies are taxed in Canada mean that investors might still need to pay tax regardless of if they made an overall profit or loss. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as. For example if you purchased 200 bitcoins.

Source: taxpage.com

Source: taxpage.com

For example if you purchased 200 bitcoins. 20600 fair market value of 25061 Bitcoins at the time of transaction - 15000 adjusted cost base of 25061 Bitcoins. If youre making money in any cryptocurrency like Bitcoin or Ethereum you may be wondering how to manage that income when filing your taxes. The portion of the Canada Revenue Agencys tax code regarding securities exchanges applies to these transactions. For example if you purchased 200 bitcoins.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bitcoin tax rate canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.